Which Best Describes the Role of a Fiduciary

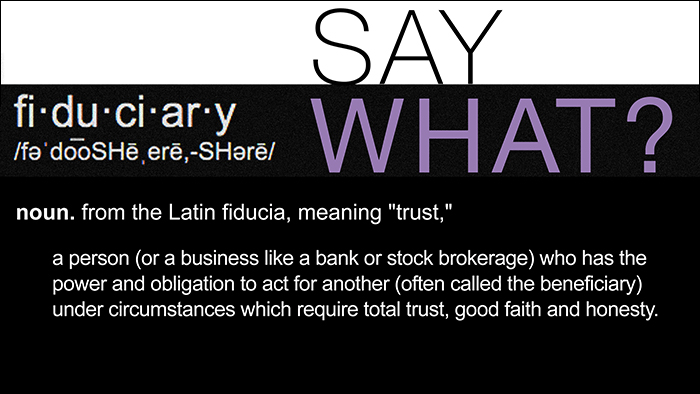

For financial advisors managing your life savings this seems like an obvious requirement. A fiduciary is someone who accepts the responsibility for taking care of the needs or property of another person for the benefit of that person.

Fiduciary Duties And The 4 Specific Types Of Responsibility

B A fiduciary relationship is established when a property manager agrees to represent an owner in leasing the owners property.

/GettyImages-695596764-f85a2ca6141c41f7ba858ffb56e9b1fd.jpg)

. In other words the agent is. If you have an attorney helping you with this case enter his or her name telephone number complete mailing address including zip code and NH Bar Identification number. Three Key Fiduciary Duties.

Fiduciary is the person responsible for managing the estate of the deceased or ward. This is commonly expressed as the obligation to provide the level of care that an ordinarily prudent person would exercise in a similar position and under similar circumstances. Enter that persons name telephone number and complete mailing address with zip code.

Which BEST describes the role of a fiduciary. Best answer B Explanation. When a professional agrees to become a fiduciary and abide by fiduciary duty it means they have agreed to put the interests of their clients ahead of their own.

The fiduciary serves in a role of trust. Agency relationships are fiduciary relationships meaning the agent owes a fiduciary duty to the principal. A fiduciary relationship is established when a property manager agrees to represent an owner in leasing the owners property.

The Role of a Fiduciary A fiduciary or corporate trustee is responsible for collecting assets paying off debts completing and filing tax returns and distributing assets according to the trust languageeither to an individual a charity or in continued trusts. A A broker can only accept a reasonable amount of profit over the agreed upon consideration. A fiduciary can only disclose confidential information obtained after termination of fiduciary relationship.

But right now its not. The fiduciary acts as your agent-in-trust. Duty of care describes the level of competence and business judgment expected of a board member.

This means they are required to act in your interest rather than to maximize their commission. According to the Merriam-Webster dictionary fiduciary means relating to or involving trust. A fiduciary can only disclose confidential information obtained after termination of fiduciary relationship.

In this case they can protect themselves by 21 ______ A setting up a. A fiduciary relationship is always created when a broker shows a buyer a house. Your financial advisor has a fiduciary duty if you trust them to buy and sell investments for you so you dont have to.

In this case the professional has a fiduciary duty to act in the best interest of their client. As the customer or member or stockholder you are the principal and the fiduciary acts on your behalf. The person served by a fiduciary places trust in the fiduciary to manage his or her affairs solely for his or her benefit and not for the fiduciarys benefit.

Most often though fiduciaries oversee trusts. In the retirement and investment management role fiduciaries oversee your assets. The entity may be a corporation or a credit union or a bank.

A fiduciary relationship is established when a property manager agrees to represent an owner in leasing the owners property. As a noun a fiduciary is a person who generally is working on behalf of someone else. A fiduciary is an entity or a person that holds assets or information for you.

Each has enough capital to invest in the business to avoid borrowing money from the bank and all of them want to limit their liability as much as possible while having a role in the management and operation of the business. Fiduciary duty also exists as a legal term in the world of business where company directors have a fiduciary duty to their stakeholders and other elements of the business depending on its structure. A trademark is a kind of protected innovation comprising of a conspicuous sign plan or articulation which distinguishes items or administrations of a specific source from those of others in spite of the fact that brand names used to recognize administrations are normally called administration marks.

Today financial advisors may choose to be a fiduciary or not. The fiduciary assumes the responsibility to carry out the instructions in the written appointing documents or where appropriate and allowed by law to use substituted judgment or the best-interest standard to handle an the persons affairs. B Employee laws ensure that all workers and employees are treated fairly with respect to wages workplace conditions medical care due to a workplace injury and employee benefits to name a few.

A fiduciary is a person who is trusted to act in the best interest of another person in a high-stakes situation that almost always involves money. A fiduciary relationship is always created when a broker shows a buyer a house. This describes the level of trust that is established between two entities such as between a professional and their client.

What Is A Fiduciary Demystifying Fiduciary Financial Advice

Creating A Comprehensive Estate Plan Requires You To Make Some Very Tough Decisions Estate Planning Estate Planning Checklist Funeral Planning Checklist

0 Response to "Which Best Describes the Role of a Fiduciary"

Post a Comment